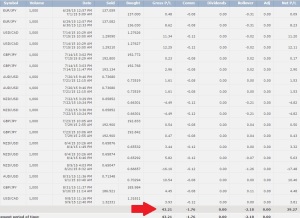

After locking in some profit on my NZDUSD trade of August 4, I wanted a new position in favor of more USD strength ahead of the Nonfarm Payroll report on August 7. My plan was to wait for the data release on August 7, and take small profit on results that either met or exceeded expectations. I made the same mistakes of not setting Stop or Profit targets, and this one really got away from me.

I made a sell order on August 4 near the long-term low at about 0.6500, and the pair climbed higher during the week. NFP data was slightly below expectations, but not enough to derail USD strength. There was a quick USD gain at the release. Not enough to put me in the money, and then BANG, the NZD climbed and climbed to above 0.6600. Everything I read online was saying that traders were booking profit before the weekend, and this was pushing NZD higher and higher. At this point, like an idiot, I CHANGED MY TRADING PLAN, and decided this was now a long-term trade of fundamental NZD weakness from the RBNZ easing cycle, against expected USD strength from an impending Fed rate hike in September or December.

Market Sentiment

- Market is bullish on USD

- NZD is the most bearish currency (as of early August)

Market Fundamentals

- More interest rate cuts from RBNZ are expected in 2015

- US Federal Reserve could raise interest rates in September or December, the first increase in about 6 years

- Expected value of NZDUSD by end of year is 0.6000 – 0.6200

Trading Plan: position for USD strength on Nonfarm Payroll data meeting or exceeding expectations. Trading against NZD which is a fundamentally weak currency.

Stupid Revised Trading Plan 2 after Trading Plan 1 Didn’t Work Out as Expected: Hold Short NZDUSD position for as long as it takes for the NZD to drop below the 0.6500 entry.

Result: After jumping above 0.6600 on August 7, I got my wish by Tuesday evening August 11, where NZDUSD dropped under 0.6500. I felt vindicated, that my prediction for NZD weakness was unfolding as it should, and thought, “No reason to close the position now, it’s a freefall from here”. The pair then turned back up, and moved sideways for 2 weeks. I decided that 0.6650 was a reasonable place to set a mental stop, and that if price moved higher than this, the trade was just flat-out wrong. I manually closed the position on Friday morning August 21 for a loss of about 160 pips (one lot only).

Comments: First mistake was making another trade without clear targets for Loss and Profit. Second mistake was changing my trading plan when things didn’t turn out the way I wanted.

I considered adding a Third Mistake, for not holding long enough, when I saw what happened on the morning of Monday August 24 at the New York market open. But 0.6650 was indeed a valid point of resistance that, when broken, was reasonable to admit that the entire position was a bad call.

The market truly freaked out this morning with Asian indexes posting HUGE drops. The NZDUSD pair gapped down from about 0.6550 to 0.6200, after hitting 0.6700 the previous Friday. This was an INSANE move. A pure knee-jerk fear reaction. This wasn’t validation that I was right the whole time, or proof that I should have waited longer. The plan was bad, the trade was bad, and my next trade will have targets before entry.